Commentary

Premium SVOD Subscribers Up 10.4% In 2024, Average Churn Moderating

- by Wayne Friedman , Staff Writer, 8 hours ago

Premium U.S streaming platforms -- subscription video-on-demand (SVOD) -- grew 10.4% in 2024 versus the year before (26.5 million to a current total of just over 260 million, according to the subscription research platform Antenna.

Netflix has a 26% market share of all U.S. SVOD subscriptions -- 67.5 million, according to estimates. Hulu and Paramount+ are next at 14% share (36.4 million) each, followed by Disney+ with 13% (33.8 million) and Peacock at 11% (28.6 million).

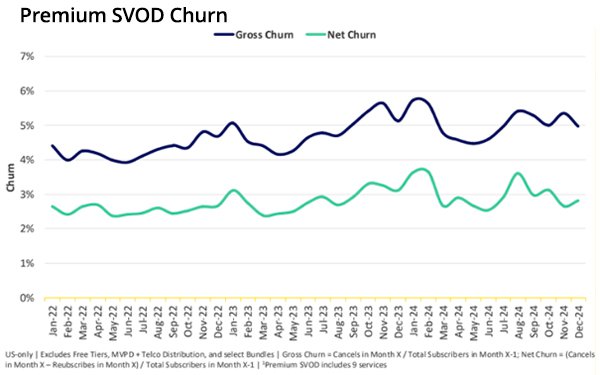

While the total number of gross additions in 2024 exceeded that of cancellations -- at 173.3 million versus 147.8 million -- the rate of cancellations grew over the rate of gross additions the year before -- 15.8% versus 11.6%.

Still, this churn is stabilizing somewhat in the near term -- at least over the final three months of 2024, at around 5%.

In addition, the average monthly churn netted just under 3% for 2024 -- when accounting for those that resubscribed to that service.

Antenna says the average price of an ad-free subscription monthly service grew to $14 from $11 last year -- with all premium streaming platforms raising prices. Ad-supported plans grew to average $7.50 from $6.00.

Overall, well over half of consumers choose an ad-supported plan when they are offered. Subscriptions to ad-supported accounted for 45% of all streaming subscriptions, up from 36% in 2023.

Antenna says bundling is having the desired effect, keeping cancellation and churn at modest levels: “Bundles are showing signs of life.”

It adds that the new Disney+/Max bundle has the highest retention rate --at 80%, which is the percentage of new subscribers who are still subscribing to those packages in its first three months in the market.

It also notes that the “Disney Bundle” -- Disney+, Hulu, and/or ESPN+ -- is at 73%.

This story has been updated.

No comments:

Post a Comment