Sports, Family, Pets See Video Ad Spend Growth in Mixed Q2

- by Karlene Lukovitz @KLmarketdaily, 72 minutes ago

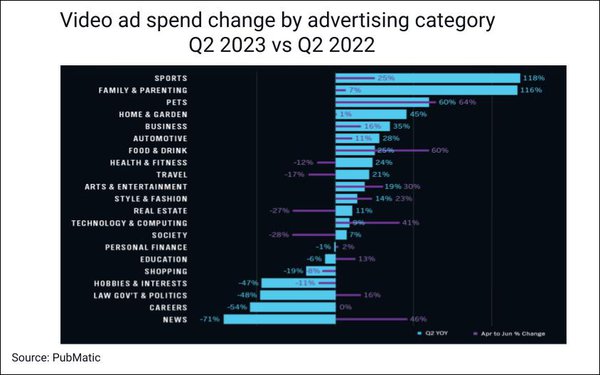

The sports, family/parenting and pets categories showed the greatest growth in programmatic video advertising ad spend amid a mixed second quarter this year, according to data from the PubMatic advertising platform.

“Similar to the retail industry, some advertising sectors experience seasonality, while others tend to flow with macroeconomic conditions — and some are at the whims of both,” notes PubMatic.

Looking at the overall picture, increased impressions volume drove 9% year-over-year growth in ad spend in programmatic connected TV and online video, but lower CPMs drove total video revenue across mobile, desktop and CTV devices for the platform down 4% YoY.

Impressions volume growth resulted in a 30% YoY increase in CTV ad revenue despite some decline in CPMs. Online video impressions across mobile and desktop also increased, but experienced double-digit percentage CPM declines that pushed revenues down more than 10% YoY.

Q2 video ad spend in the sports category more than doubled over Q2 2022 (up 118%), and sports spend also grew 17% YoY across all digital formats. But the category’s video growth rate between April and June of this year was a more modest 25%. Overall category spending rose between April and May, but fell in June.

The family and parenting category saw Q2’s second-largest growth in YoY video ad spend, at 116%. Its video growth between April and June was just 7%, however.

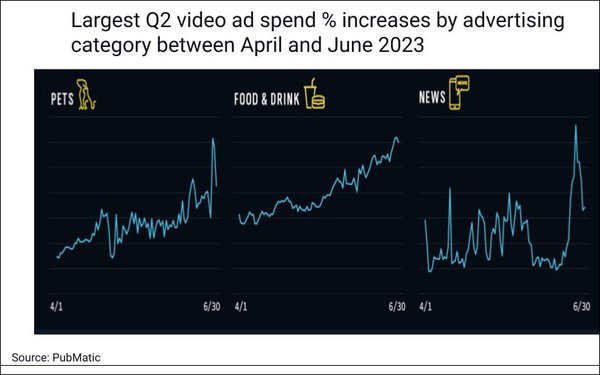

The pets category saw the largest spend growth overall in Q2, and the third-largest YoY growth in video ad spend (up 60%). This category also saw strong video growth between April and June: up 64%.

Food and drink also saw rapid growth in Q2, including increases in spend in both display and video ad formats. Video spend grew 25% YoY and shot up by 60% between April and June.

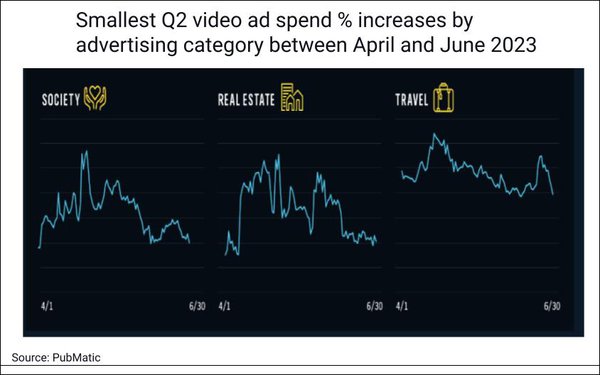

Home and garden video ad spend was up 45% YoY, but barely rose (up 1%) between April and June this year. Overall spend in the category rose in April and May, but fell in June.

News, careers, law/government/politics and hobbies and interests were the hardest-hit in terms of Q2 YoY video ad spend, but news, in particular, rebounded between April and June. (Although PubMatic doesn’t mention this, the news uptrend corresponded with a series of indictments against former President Donald Trump.)

Shopping suffered a 19% drop in YoY video spend, and spend in the category declined 8% between April and June.

Shopping suffered a 19% drop in YoY video spend, and spend in the category declined 8% between April and June.

No comments:

Post a Comment