COMMENTARY

65% Of CTV Advertisers Upping Spend In 2023, By Average 23%

- by Karlene Lukovitz @KLmarketdaily, June 30, 2023

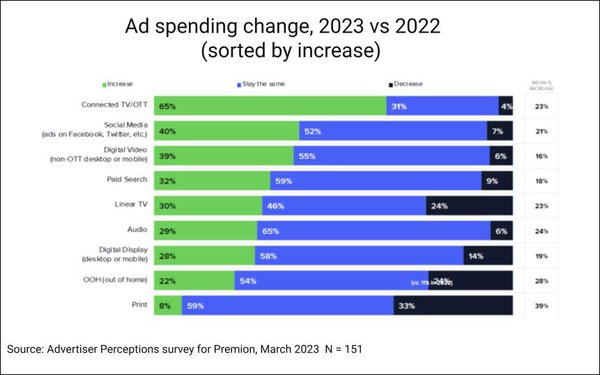

A new survey of agency and brand marketers involved in decision-making for connected TV/OTT advertising finds 65% indicating that they’ll increase spending in those media this year, by an average 23%.

For the anonymous survey, conducted among 151 U.S. advertising executives in March by Advertiser Perceptions for Premion, respondents were required to have used CTV/OTT advertising in both 2022 and 2023, and spent a minimum of $250,000 annually on advertising.

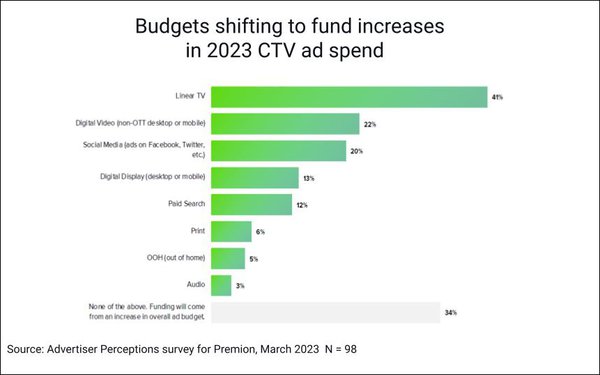

Among advertisers increasing their CTV budgets, 41% are shifting some money from linear TV, 22% from digital video (non-OTT desktop/mobile), and 20% from social media. A third (34%) say funding will come from an overall increase in their budgets.

Spend increases are being driven by the ability to capture declining TV audiences (46%), provide the benefits of TV with digital capabilities (44%), achieve both brand awareness and performance marketing goals (39%), extend reach for linear campaigns (37%), achieve precision audience targeting (35%), and provide affordable TV options for performance-driven digital marketers (36%). One third said that CTV tends to outperform linear TV.

Achieving brand awareness and performance marketing goals and realizing the benefits of TV with digital capabilities top the list of CTV/OTT advertising benefits (each cited by 38%), followed by extended reach for linear TV campaigns and capturing declining TV audiences (each at 37%), and precision audience targeting (36%).

More than a third (36%) of CTV advertisers see CTV mainly as an extension of linear TV buys, 40% as both an extension of linear and a complement to digital buys, and 25% mainly as an extension to digital buys.

Two-thirds or more agree that combining linear TV and CTV advertising ensures reaching the total desired audience and is integral to a complete TV advertising strategy (each at 69%), improves full-funnel ROI performance (67%), and increases brand awareness (66%). Sixty-four percent say it drives greater ROI.

More than half agree that co-viewing is a value-added benefit of CTV advertising and/or provides a like-for-like comparison to linear TV.

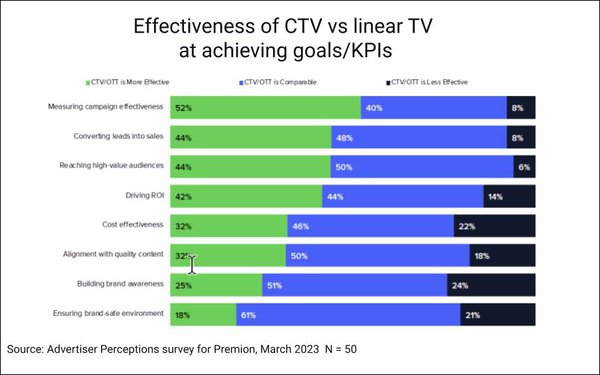

Surprisingly, given the results of previous surveys of buyers, and industry executives’ observations up to this point about the confusion around CTV performance measurement, half (52%) said they consider CTV to be more effective than linear at measuring campaign performance, and 40% say it’s comparable, while just 8% say it’s less effective.

In addition, 44% say CTV is more effective than linear at converting leads into sales, and 48% say it’s comparable; and similar percentages say the same about CTV’s ability to reach high-value audiences and drive ROI.

Somewhat smaller numbers say CTV’s cost-effectiveness is better (32%) or comparable (46%) to linear’s.

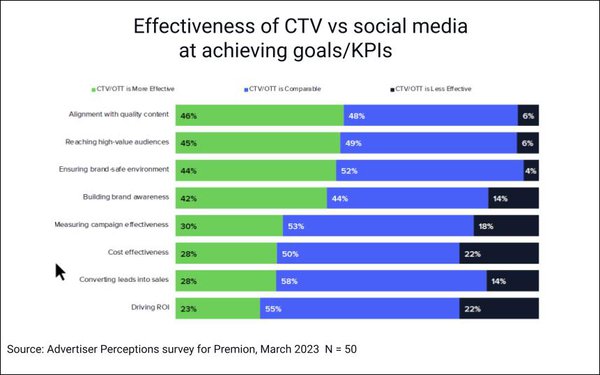

Similar percentages say that CTV’s effectiveness in achieving KPIs is better or comparable to digital video’s and social media’s.

As for CTV’s challenges, just 30% of these buyers cited inconsistent measurement standards as one of the biggest problems — again, a contrast to previous surveys, which have consistently shown measurement as a top advertiser concern about CTV.

Has the CTV measurement scenario — or at least perceptions of the severity of its problems — improved in recent months? Certainly, advertising platforms have introduced a plethora of new cross-channel/convergent TV measurement solutions in the past year, and there’s also been the high-profile advent of the U.S. Joint Industry Committee to establish certified alternative ad buying currencies across premium video channels.

One survey is hardly confirmation of a shift in perceptions and/or reality on this front, but it’s still intriguing.

These buyers cited difficulty in managing ad frequency cross publishers/platforms as CTV’s biggest challenge, followed by insufficient reach/scale to target effectively, media/provider fragmentation, transparency on where ads are running, disparate reporting across multiple buys, and cost.

No comments:

Post a Comment