Total ad spending is forecast to grow an average 5.0% annually through 2020 according to a new report issued today by MyersBizNet, the leading independent forecaster of advertising and marketing investments since 1986.

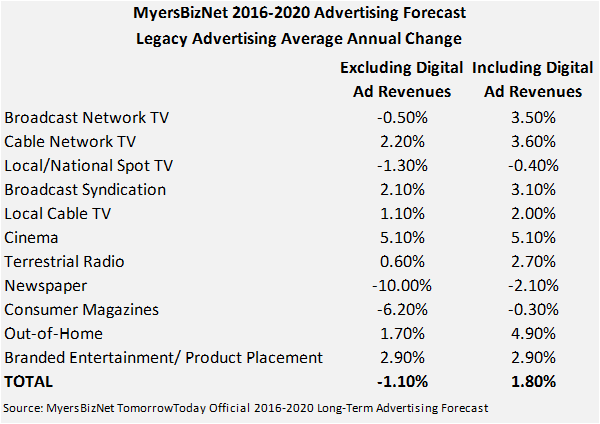

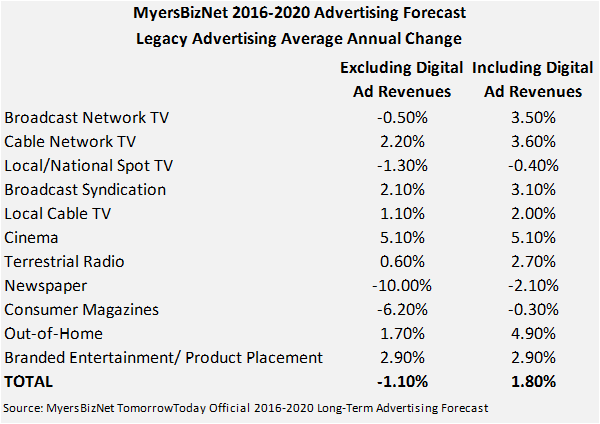

Ad spending growth is led, of course, by digital media including the digital assets of legacy media companies. MyersBizNet projects total digital advertising will increase an average 21.2% annually from $58.3 billion in 2016 to $113.3 billion in 2020. Legacy media categories, excluding their digital revenues, are forecast to decline an average 1.1% annually from $129.4 billion in 2016 to $124.7 billion in 2020.

Based on these forecasts, suggestions that total digital spending (excluding search) will surpass legacy advertising are exaggerated. Mobile and online search investments are reported separately in MyersBizNet’s below-the-line marketing data, due to be released later this month.Mobile advertising (excluding search) is forecast by MyersBizNet to increase an average 32% annually, from $20.3 billion in 2016 to $41 billion in 2020. The greatest growth category is interactive/VOD and addressable advertising, which MyersBizNet projects will increase from $704 million this year to $8.7 billion in 2020, an average of 84% annually.

Advertising placed with online originated video content sites is estimated to increase 36% annually to $14.0 billion in 2020 from $5.5 billion in 2016.

Declines in legacy spending are led by traditional newspaper (-10.0% annually) and consumer magazines (-6.2%) advertising. The fastest growing legacy spending is for cinema advertising, with projected annual growth of 5.1%.

The digital and total revenues of these legacy media 2016-2020 are provided in the full MyersBizNet long-term advertising spending report available at MediaVillage. MyersBizNet includes 18 media categories in its above-the-line advertising data, with legacy and digital spending in each category reported separately. MyersBizNet will publish Hispanic media data and below-the-line marketing forecasts later this month.

The digital and total revenues of these legacy media 2016-2020 are provided in the full MyersBizNet long-term advertising spending report available at MediaVillage. MyersBizNet includes 18 media categories in its above-the-line advertising data, with legacy and digital spending in each category reported separately. MyersBizNet will publish Hispanic media data and below-the-line marketing forecasts later this month.

Based on these forecasts, suggestions that total digital spending (excluding search) will surpass legacy advertising are exaggerated. Mobile and online search investments are reported separately in MyersBizNet’s below-the-line marketing data, due to be released later this month.Mobile advertising (excluding search) is forecast by MyersBizNet to increase an average 32% annually, from $20.3 billion in 2016 to $41 billion in 2020. The greatest growth category is interactive/VOD and addressable advertising, which MyersBizNet projects will increase from $704 million this year to $8.7 billion in 2020, an average of 84% annually.

Advertising placed with online originated video content sites is estimated to increase 36% annually to $14.0 billion in 2020 from $5.5 billion in 2016.

Declines in legacy spending are led by traditional newspaper (-10.0% annually) and consumer magazines (-6.2%) advertising. The fastest growing legacy spending is for cinema advertising, with projected annual growth of 5.1%.

The digital and total revenues of these legacy media 2016-2020 are provided in the full MyersBizNet long-term advertising spending report available at MediaVillage. MyersBizNet includes 18 media categories in its above-the-line advertising data, with legacy and digital spending in each category reported separately. MyersBizNet will publish Hispanic media data and below-the-line marketing forecasts later this month.

The digital and total revenues of these legacy media 2016-2020 are provided in the full MyersBizNet long-term advertising spending report available at MediaVillage. MyersBizNet includes 18 media categories in its above-the-line advertising data, with legacy and digital spending in each category reported separately. MyersBizNet will publish Hispanic media data and below-the-line marketing forecasts later this month.

No comments:

Post a Comment