Nothing is ever guaranteed in business. However, you stand a better chance if you know how to create a marketing strategy for business success.

A marketing strategy helps you set a clear direction for your marketing campaigns. It helps you clearly define your marketing goals, channels and key messaging to sell your products and services effectively.

This quick guide will show you how to create a marketing plan aligned with your business goals. Whether you’re starting a new business or have an established one, this guide will help you.

How to Create a Marketing Strategy for Business Success

Marketing can transform your business when done right. Here is a step-by-step guide on how to create and execute marketing strategies to get the best results.

1. Define Your Business Goals

You first need to understand the direction your business is taking before setting marketing goals. Review your business mission and vision alongside your short- and long-term goals.

A good place to start is using the SMART goals strategy. The business goals should be specific, measurable, achievable, relevant and time-bound.

For example, when it comes to specificity, avoid vague goals like “increasing brand reach.” Instead, make it clear like “increase social media reach by 15% in three months through ads.”

Here’s an image that illustrates a process you can follow to set goals.

Image via Quality Assurance Solutions

2. Conduct Market Analysis

Market analysis involves evaluating your specific market to understand current conditions, trends and potential opportunities. You must understand your industry, target audience and competitors before launching any marketing campaign.

Analyzing market trends helps you keep tabs on major changes that impact your business. Follow this up with creative ways of reaching your target audience by studying their behaviors and needs.

Finally, look at your competitors and the strategies they’re using. Check out their social media, websites and customer reviews to identify their strengths and weaknesses.

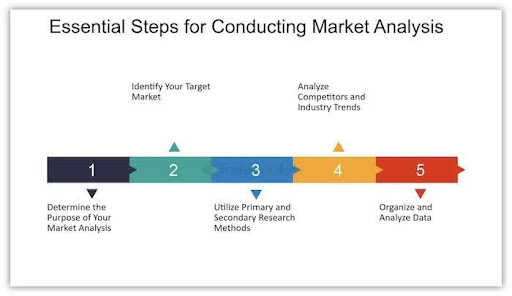

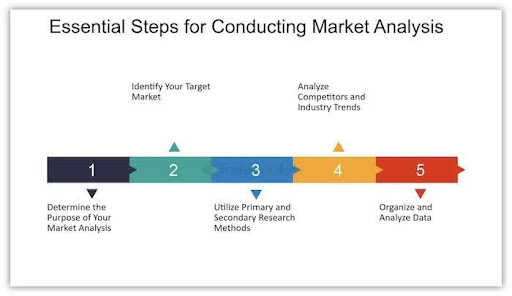

Thorough marketing research is an effective way of identifying gaps you can exploit. Here’s a visual illustration of the market research process you can follow.

Image via Faster Capital

3. Set Your Marketing Objectives

Marketing objectives are specific measurable goals you plan to achieve through marketing efforts. Examples include increasing brand awareness, generating leads, boosting sales or improving customer retention.

You need to set up marketing objectives that are measurable using key performance indicators (KPIs). Tracking your progress this way helps you know early on if your marketing plan is working or not.

For instance, if you’re targeting social media engagement, then your KPIs could include the number of likes, comments and shares.

Set your marketing objectives based on your overall business goals. Here’s how.

Image via Coschedule

4. Choose Marketing Channels

Marketing channels are platforms and mediums your business uses to reach your target audience. Choose multiple channels that can help you reach your target audience.

These channels can either be digital or traditional. Digital marketing channels include saas email marketing, social media and SEO. They are ideal for tracking or calculating vital data like campaign impressions in real time.

Traditional channels include TV, direct mail and print ads and they work best for older audiences. Ultimately, the best approach would be going with a multi-channel integration to cast a wider net.

5. Create a Timeline for Implementation

Every marketing plan needs a timeline of implementation to help you organize and keep your marketing efforts on track. You can achieve this by using marketing calendars to map out when each campaign will start and end.

For example, you can schedule blog posts and social media campaigns leading up to a product launch. Speaking of social media, be sure to explore Attrock’s curated list of the best social media marketing tools.

Lastly, consider rolling out your marketing plan in phases instead of launching everything at once. This creates room for instant adjustments as you monitor the results.

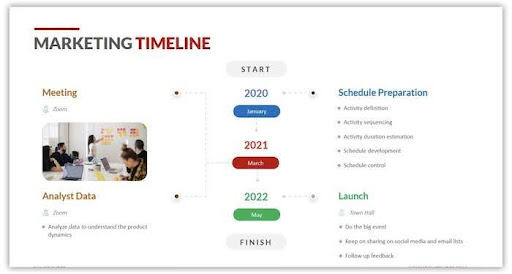

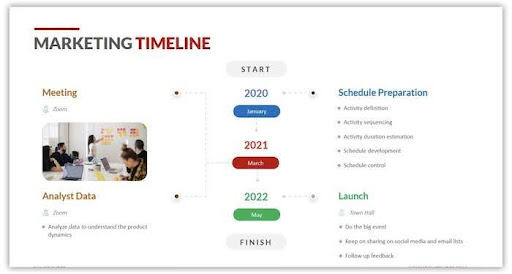

Here’s an example of how to build a marketing timeline.

Image via Powerslides

6. Set a Marketing Budget

A marketing budget is more than just ad money. It involves allocating available resources effectively to maximize the returns on investment (ROI) from your marketing efforts.

The budget is mostly influenced by the medium you intend to use and usually, digital mediums are cheaper. For example, hiring influencers or using ambassador marketing may be cheaper than paying for a billboard ad.

Other cost considerations include marketing automation tools, branding efforts, software subscriptions and market research.

Ideally, you should develop your marketing budget toward the end of creating your marketing plan. At that stage, you already have a clear picture of what you need. Here are some benefits of setting a marketing budget.

Image via Faster Capital

7. Execute the Marketing Plan

With everything in place, it’s time to put your plan into action. Start by delegating responsibilities and ensuring everyone in the team understands their deliverables. For example, a social media manager handles social media posts while a content strategist deals with blog posts.

Seamless teamwork among different team members will help you hit your online business goals faster.

Additionally, it would help to use project management tools like Trello or Asana at this stage. These tools make assigning tasks to team members easier and more manageable.

Turn Things Around with a Good Marketing Strategy

That’s how to create a marketing strategy for business success. The first steps involve defining your business goals, conducting marketing research, and setting your marketing objectives.

The results may not be instant, but by following these tips, your business stands a better chance at success. So try them today and share with us more tips you believe may also work in the comment section.