|

|

Blogging By Dr. Philip Jay LeNoble discusses the sales and sales management structure of media marketing and advertising including principles, practices and behaviorial theory. After 15 years of publishing Retail In$ights and serving as CEO of Executive Decision Systems, Inc., the author is led to provide a continuum of solutions for businesses.

|

|

Brands and agencies often use the terms “advertising” and “marketing” synonymously, resulting in confusion and a myopic view of the mechanisms that may be used to solve a brand’s business challenges. Business suffers then, because only a small portion of the customer’s journey and marketing funnel is being influenced (via advertising), versus an impact on results across the funnel, the customer experience, and the brand’s bottom line at the end.

While advertising is critical in delivering content to customers to drive awareness and consideration, change perceptions, or even drive action, it must be used in conjunction with other marketing techniques to fully impact a brand’s business and deliver a full-funnel solution.

For example, simply advertising a certain aspect of a brand’s value proposition without fully incorporating the same content across other owned and earned channels — as well as ensuring the value proposition is being delivered via customer journey research — could potentially result in a brand wasting its precious marketing budgets without achieving any real business results.

How Marketers Bring True Value

By understanding a customer’s individual needs and preferences, marketers can drive relevant, personalized content across the entire customer journey and convince customers to move from one point to the next and, eventually, take the final step of transacting with a brand. Marketers can develop content, offers, and calls to action by mapping the individual’s needs to business goals at each point of the customer journey.

Attracting the right audiences and providing relevant and personalized content through the journey is the true value that marketers bring. Here are some ways that marketers should be approaching and prioritizing these efforts:

1. Journey mapping: To drive impact and business results, marketers must start with understanding and documenting the customer’s (current and ideal) journey with the brand or product, breaking it down into phases and milestones, triggers and barriers (emotional and physical) at each phase, and defining business goals for each milestone. This helps marketers develop a blueprint that can be used to define and design the ideal user experience across touchpoints or channels to accomplish the goals for each phase or milestone in the journey and, in turn, help deliver bottom-line results for the business.

2. Customer segmentation and UX design: Brands must also invest in research and analytics that helps them understand the profiles (demographic, psychographic) of their customers as well as their needs and preferences across the various phases of the customer journey. These insights should then be used to group customers into segments and develop relevant experiences in order to attract, capture, and retain each segment and maximize the return of marketing investments.

3. Measurement and optimization: Definition of clear goals and continual measurement of efforts across the various parts of the customer journey are other integral and essential components of a successful marketing program. KPIs grounded in business goals help teams understand the effectiveness of marketing tactics so they can optimize spend, targeting, and experience to deliver a higher ROI.

TV upfront marketplace, including broadcast and cable TV networks, posted “modest” gains -- up 5.8% to $20.1 billion, according to estimates from Media Dynamics.

While broadcast and cable networks grew similarly in volume -- up 6.4% (to $9.9 billion) and 5.2% (to $10.2 billion), respectively -- broadcast showed strength when it comes to prime-time 30-second commercials in terms of the cost-per-thousand (CPM) viewers.

Broadcast grew 9.6% to $47.14, while cable TV networks rose 6.6% to $23.30.

“[There was] a definite softness in cable sales relative to broadcast, as many buyers felt that they were better off diverting fairly large sums to streaming venues -- despite their higher CPMs -- as a hedge against future scatter market pricing for broadcast prime,” says Ed Papazian, president of Media Dynamics.

Overall, he adds, these gains "were well below last year's spectacular hikes due to buyer concerns about the looming threat of an economic recession."

A year ago, big broadcast TV networks in the upfront market for the 2021-2022 season took in an average 19% gain in prime-time broadcast CPMs, and 10% higher for cable TV networks, according to Media Dynamics.

This year is different. He says: “Linear TV sellers were willing to trade off smaller CPM increases for their linear TV platforms in exchange for increases—often at higher CPMs—for their streaming services.”

Supply-chain problems and fears about inflation are not preventing consumers from spending online.

Average order value increased by 19% in Q2 compared to Q1, according to an analysis by customer platform Klaviyo.

Yet brands are offering 18% fewer discounts as they cope with increased prices for goods.

Meanwhile, small businesses that sent “Back in Stock” emails saw a 9% increase in order value compared to the prior quarter.

Klaviyo defines “small” as firms with less than $5 million in revenue.

The sheer number of orders increased in several categories, compared to Q1:

In contrast, health and beauty orders increased by only 2%, and the average order value by 1%. And consumers placed 5% fewer electronics orders.

In addition, consumers placed only 2% more orders for home goods in Q2, with the average order value rising by 7%, probably due to inflation.

The average order value is up 24% in the U.S., compared to 9% in EMEA and 2% in APAC.

“Despite the economic headwinds, consumer spending in certain categories continues to be consistent, particularly in categories like apparel and accessories as consumers start attending more events and returning to the office,” concludes Andrew Bialecki, CEO and co-founder of Klaviyo.

Bialecki adds: “While consumers might pare back on buying higher priced goods like electronics, or price shop for more ‘essential’ goods, they’re still going to buy from the brands they love.”

Klaviyo examined results from over 300 million global shoppers across more than 80 countries and territories powered by the company’s platform.

According to some, we are in the last throws of the Western democratic industrial model. Plagues, crumbling economies, migration, inequality of access to food, shelter, income and healthcare, as well as climate change, are all indicators of the beginning of the end, say doomsday believers.

Some people like to add that the end must be near, because we are living in a decadent society which is losing touch with its morals and basic believes. And I am almost ready to believe them when I take the following, totally subjective and self-observed occurrences, into consideration.

First proof point: since going off cable, and full-time on streaming, my family is now being held hostage by the power of poorly functioning ad serving algorithms. During the live evening news, watched via the app of our local news station, we sometimes get served the same Chevy Equinox or Chevy Truck Month ad seven times, back-to-back. In three or more consecutive breaks. I do not know if Chevy has tested this tactic as successful, but I hate Chevy for it, along with its media agency and my local news station. This is what you get from a crappy programmatic algorithm, a lazy agency and station, and a non-capped reach and frequency incentivized media plan. It demonstrates a pure lack of media plan management morals.

Second proof point: ads on TV for stuff I did not know needed ads on TV for. Or needed mentioning at all. There is Pete Davidson selling a product called “Manscape." It is a shaver you are supposed to use for all your body hair. Everywhere.

At the same time, P&G is singing the praises of pubic hair in a catchy tune for Gillette, wanting to “unshame” the having of body hair. I think we can agree the end of times are near if we both promote the having of, and the not having of bodily hair, in TV ads, in one ad break.

Third proof point: spending money on celebrities and then giving them splashy marketing titles, as if the sponsorship deal really is some kind of employment agreement. The latest I saw reported on Bloomberg: “Kate Moss has been appointed creative director of Diet Coke as the brand celebrates its 40th year. The catwalk star, 48, will partner with some of the world's leading fashion houses as part of a new campaign to promote the drink using the slogan "Love What You Love."

To use a British description: what a load of bollocks. What really happened here is “we paid Kate Moss to appear in our ads and some of our events." Diet Coke is trying to pretend something that isn’t what it is. Surely another sign, right?

Marketers continue to feel overwhelmed. Mediapost reported on that this week: “Marketers are overwhelmed by their workloads. For one thing, they have far too many sources to wade through to get the information they need, according to Marketing Trends Report, a study from Airtable.” And they continue to be fired and replaced faster than you can say “integrated marketing strategy”.

I hope that the examples mentioned here are merely a proof point of stressed-out marketing leaders who got lost wading through far too many sources for data and insights, and that it is not the beginning of the end of marketing and Western Civilization as we know it.

And that is a positive, right?

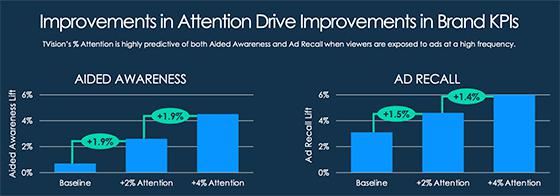

There is a direct “one to one” correlation between TV commercials' "attention" score and marketers' all-important "brand lift" measure, according to a survey from TVision, a TV measurement company and Upwave, an advertising-tech brand-measurement company.

“We found proof of strong correlations,” said the companies, “between the percent of attention... and lift in aided awareness and ad recall,” TVision measures second-by-second, person-level data about how people watch TV using “eyes on the screen” technology.

"Aided awareness'" is the percentage of respondents aware of a marketer's product, brand, or advertising when asked.

For example, if a campaign reaches 100 million people, which gets a 38% score in “attention” -- instead of 34% -- that means an extra 4 million people recognizing one's brand.

Digging deeper, the research also notes that “attention” can vary greatly between high and low placements depending on daypart, network, and program. For example, programming can show a 43% difference, while networks can show a difference of 23%: and dayparts, 9%.

TVision and Upwave research comes from linear regression analysis of more than 40 national campaigns between the fourth quarter of 2019 and the first quarter of 2022.

Campaigns from ad categories include those in finance, consumer packaged goods, fast food, automotive, retail, telecommunications, and pharmaceutical.

In 1992, Bill Clinton was elected President. The media was quick to attribute the success of his campaign to capturing the votes of “Soccer Moms.”

It was the first time the media had focused on women with children as a collective powerhouse of voters, consumers and decision makers. Never before had so much media attention shined on moms until 2022 -- the year of formula shortages, angry school board meetings and professional women who hold positions as first responders and educators.

As someone who has written about the power of moms since 1999, I’d like to say the attention they’re garnering today is a long time coming. It’s unfortunate that it took a pandemic, formula recall, $5/gallon gas and rising prices at the grocery store to do it.

Nonetheless, as a marketer, congratulations to the brands who have decided to put their advertising dollars focused on tapping into the $3.1 trillion moms spend collectively in the U.S. economy each year.

I’m not accusing brands of ignoring moms as purchasers. I believe that companies such as Proctor & Gamble, Kimberly Clark and Kellogg’s have long known that moms are their main target as buyers.

However recently I’ve seen traditional television ads focused on marketing to moms by the likes of Bank of America, Swarovski, Carhartt, and Google. I can’t help believing that recent headlines highlighting the innovative ways moms are coming together to source formula or moms developing less expensive solutions to every day consumables have contributed to the awakening of marketing departments across Fortune 500 global brands toward moms as consumers.

If your company is still sitting on the sideline trying to figure out how to better tap into the buying power of moms, here’s a few tips.

Start by listening to your customer. It’s so easy to do this in today’s world of social media. Search hashtags related to your product and find out what moms are saying about you and your competitors. Resist the urge to jump into the social conversation with comments, likes or shares until you clearly understand the mom's point of view.

Establish a long-term relationship with mom consumers. Executing a one-off campaign won’t work. Moms want to have a relationship with the brands, products and companies they do business with. This can be following them on social or serving as an ambassador in their local market.

Create content that’s relevant and timely. Sending a back-to-school coupon is great, but sending it out in September misses the target. Moms begin preparing for back to school in July, because most schools south of the Mason Dixon line return to the classroom in August. Unfortunately agencies and media based in New York City recognize back to school as the day after Labor Day, when their local students return to the classroom. Point is, good content delivered at the right time is a great way to establish a relationship with moms.

Use influencers wisely. Seek out mom influencers with high engagement rather than large numbers of followers. The power of word-of-mouth marketing among moms is their interactions with each other. Don’t be fooled by influencers or agencies that sell you on impressions. If no one is listening, it doesn’t matter how many moms on their feed.

As consumers begin to tighten their spending, it’s a good time to target moms, who control America’s household spending.

Local over-the-top (OTT) TV advertising is estimated to sharply climb to $2 billion in revenues by the end of this year -- up from $1 billion in 2020, according to a new study.

The research comes from BIA Advisory Services, a local media consultancy, and is sponsored by Vevo, the digital music video network.

The authors say the average compounded annual growth rate (CAGR) over the past two years for OTT was 43% -- which makes it the fastest-growing local media.

After local TV OTT comes local digital radio, with an annual growth rate of 24.3% over the last two years, followed by local mobile at 20.8%, local digital magazines at 17% and local PC/laptop advertising at 16.6%

The top advertising local OTT category for 2022 is projected to be general services, at $337.2 million. This includes legal/law firm businesses, as well as plumbers, HVAC contractors, utilities, and funeral home operators, to name a few.

The second-biggest local OTT category is automotive, at $273.2 million, followed by restaurants ($203.4 million); health ($202.8 million); and finance/insurance ($182.8 million).

Looking at six U.S. regions, the biggest growth was in Mid-Atlantic markets, with 53% CAGR, and the lowest was the Pacific Southwest, 39% Other regions were as follows: Northeast (47%), Southeast (40%); Midwest (42%) and Pacific

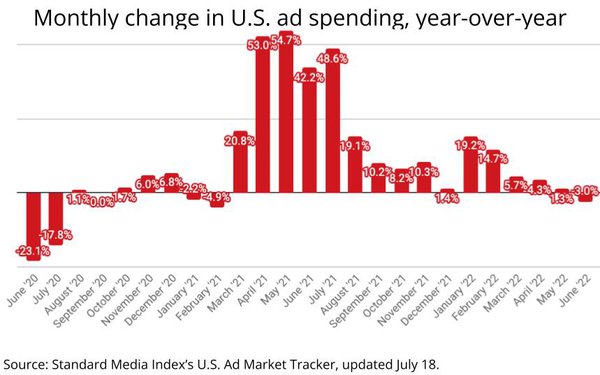

The U.S. ad market contracted 3% in June, marking the first decline since February 2021, according to a MediaPost analysis of data from Standard Media Index's U.S. Ad Market Tracker.

The contraction follows a steady deceleration of the U.S. ad market's expansion coming out of the COVID-19-related advertising recession.

Relative to June 2020, which fell 23.1%, June 2022's ad market index actually expanded 36.6%.

Most of the June 2022 contraction was due to reductions by the nation’s largest advertising categories. Spending by the top 10 categories fell 5.2% in June, while all other categories actually expanded 1.2%.

Most of June’s erosion occurred among traditional media spending.

Among media, the erosion was mostly among traditional media, which contracted 16.6% from June 2021, while digital expanded 8.6%.

Digital’s share of all media spending rose to six points to 62% in June

Email is the preferred communication channel of consumers: 52% choose it, versus a distant 17% for text and 14% for online accounts.

But young people are not as fond of it as their elders, according to the 2022 Digital Communications Market Study, a new report from Idomoo.

The rate of email preference varies greatly by age cohort:

Despite all that, the study seems more focused on showing the growing popularity of video.

Of those polled, 62% want more video, but 74% rarely or never receive it.

The study also found that video is the preferred medium for brand communications, especially among Gen Z and high-income earners.

For instance, 40% of Gen Z and 61% of the high earners, who presumably are older, are most likely to want personalized video.

In addition, 59% of Gen Z and 47% of high earners are most likely to desire video interactivity. And 69% of Gen Z and 33% of high earners want videos they can customize.

The similarity is also seen in trust in brands.

Overall, 55% of consumers trust brands to keep their data secure, versus 16% who don’t trust them, 26% who are neutral and 4% who don’t know. And 72% will share data in return for personalization.

Gen Z and millennials are 20% more likely to share information, and high earners are 25% more likely.

It could be that Gen Z and the high earners feel more free to let their imaginations wander.

When do people expect a brand to understand their needs and interests and tailor content for them? They say:

And how should brands show they understand customers? They expect to be recognized by:

Meanwhile, 71% more people saw an increase in personalized brand communications since the pandemic began, versus those who said they did not see an increase. Americans were 20% more likely to note an increase.

Continuing the country comparison, 30% of UK consumers don’t feel valued by brands, compared to 20% in the U.S.

Can this be the reason? Only 13% of UK consumers have ever received a personalized video, compared to 22% in the U.S.

On behalf of Idomoo, Arlington Research surveyed 2,000 consumers in the U.S. and UK in January 2022. These respondents have a relationship with a brand. High earners are defined as those with $150,000+ annual income in the U.S., and £75,000 in the UK.

Two Senate Democrats are questioning Facebook and Instagram over reports that the platforms have been removing posts related to abortion.

It's now “more important than ever that social media platforms not censor truthful posts about abortion, particularly as people across the country turn to online communities to discuss and find information about reproductive rights,” Senators Amy Klobuchar (D-Minnesota) and Elizabeth Warren (D-Massachusetts) say in a letter to Facebook CEO Mark Zuckerberg and Instagram head Adam Mosseri.

The lawmakers say the Supreme Court's recent decision in Dobbs v. Jackson Women’s Health Org., which cleared the way for states to outlaw abortion, led to a spike in social media posts about abortion.

“Many took to social media to share stories about the impact of the decision, let others know how to legally obtain abortion services, and to discuss their personal experiences,” Klobuchar and Warren wrote.

The pair added that reports indicate that Facebook and Instagram removed “multiple posts providing accurate information about how to legally access abortion services,” and tagged other posts with warnings.

Meta spokesperson Andy Stone said late last month that the company doesn't allow any posts offering to sell or donate pharmaceuticals.

He added that the company had “discovered some instances of incorrect enforcement and are correcting these.”

Klobuchar and Warren are now asking Meta for detailed information about their content-moderation policies regarding abortion related posts, including how many such posts have been removed since June 24 -- the date of the Dobbs decision.

Early entrants in the loyalty marketing space are seeing the enormous opportunity this data holds for their own companies as well as other brands looking to reach those same consumers. Furthermore, brand marketers without access to these robust customer databases are realizing they need to find long-term targeting solutions (and fast) as they face the impending challenges of the cookieless future.

Thus, retail media networks were born and have exploded, with a new solution seeming to emerge every other week.

Marketers who are continually pressured to show immediate ROI are drawn to the end-to-end solutions from targeting to measurement, being able to tie incremental sales to their advertising efforts.

But what are the roots at the foundation of retail media’s success? Trust, segmentation, accountability, scale.

Learn how brands can build on these four key principles of retail media networks and improve their marketing efforts across all channels.

#1 Trust and convenience are everything. This valuable consumer data is available because brand loyalty was a priority for these retailers. And in order to gain brand loyalty, you first have to build trust. Is there consistency in their consumer touchpoints? Are the desired products and services always, or at least consistently, available? Are the employee-customer interactions positive and helpful?

If the answer is yes, the customer will continue to return, warranting the time spent to enroll in a loyalty program. One-time shoppers won’t even spend the two minutes to save $5 if the experience is negative to neutral and they don’t have a reason to return.

#2 Smart customer segmentation and analysis are essential. Without proper segmentation and analysis of your customer base, consumer data is only providing a fraction of its value. Drive learnings from this data collection to help improve the customer experience and provide personalized engagements. By understanding your customers on both a personal level as well as cohorts based on common likes and interests, you will be able to drive affinity through unique offers and discounts, leading to cross-selling, upselling, and incremental store or site visits.

#3 Accountability is the gateway to success. Retail media is wildly popular with CPG brands because it informs the answer to the question of “Is the marketing working?” Being able to tie ad exposure to sales is important to show how and if marketing efforts are resulting in meaningful business outcomes. Without the proper accountability to understand if your marketing is driving results, you are, at worst, causing waste and, at best, flying blind. Put together a smart strategy to keep your media accountable at each stage of the marketing journey. Even if retail media isn’t the ideal solution for your brand, identify measurement partners that can help you determine if you are moving the needle in the right direction.

#4 Scale sells. When you are talking about retail networks the size of Kroger, Walgreens, and Walmart now offering access to their customer data for targeting, the number of customers alone is enough for marketers to see dollar signs in their eyes. This is especially true for brands whose CRM data is minimal. Lean into these second-party data providers to supplement your own data targeting, while continuing to use lead-generation strategies to grow your data over time.

Emotional attachment to TV commercials is something NBC wants to consider -- as well as its value for its marketers.

Now before you roll your eyes and take a big sarcastic breath, let’s dig deeper. This isn’t your father's fuzzy consideration of what value a TV advertising is worth. New science is behind it.

Let’s start with the general premise, concerning other TV content -- TV programming.

Kelly Abcarian, executive vice president of measurement and impact for advertising and partnerships at NBCU, in a blog post, suggests that if TV networks continue to hone in on why certain shows emote specific “emotional” attention -- and get high viewership and engagement -- shouldn’t marketers also want the same thing for ad creative?

It kind of makes sense, especially in a streaming world where there can be limited ad availability. Thus, each piece of creative -- with hopefully less frequency as well -- becomes that much more important. At the same time, we know that TV sellers selling streaming ad inventory may want a higher price. (Oh well. You get what you pay for -- mostly).

Consumers would generally rather not want to see any advertising.

Cost is always an issue. Want to spend $15 or $16 a month for the likes of an HBO Max or Netflix, or -- on the other end of things -- $5 or so a month for a Apple TV+, Paramount+, and Peacock? That's the new TV battleground.

So what might then make it easier for consumers when it comes to those lower-priced considerations? Finding the best possible advertising content that goes along with the programming content, that's what.

But what about that "fuzziness" -- creative value attached to emotions for each consumer, and then attached to those TV commercials?

Well, that apparently was in the past. New measurement systems -- such as Dumbstruck -- can combine insights from psychology, cutting-edge facial coding and eye tracking AI, says Abcarian.

Other companies are doing similar work -- including System 1, Emoto.AI, Kantar’s Link Ad Test, and Dynata's Ameritest.

Abcarian says NBC is working on building a “scalable model for creative testing” that “evaluates the emotional resonance of creative.”

This is all to say that future “alternative” measurement systems -- which are all the rage -- should not just be concerning measuring or guaranteeing on a specific set plain-old, diverse pieces of audience data, such as marketers' pre-set business outcomes levels or matching first party data of NBCU viewers with that of first party data of marketers.

The bigger question starts not only figuring out what viewers liked -- whether they were entertained by a commercial -- but what specific emotions were revealed. Consider everything I'm guessing: Cry, laugh, mull, or melancholy gazing into space included.

Decades ago these companies and others made a prescient, and obvious, move in transitioning from being just cable TV operators into a fast-growing broadband business (which now makes up the majority of revenues) as many communications lines led into the homes.

But now that business has slowed -- and in future estimates, will continue to weaken -- in terms of subscriber growth. Wells Fargo estimates cable broadband growth to slow to an average of 2.4% per year (2020 to 2025) from around 4%.

Benjamin Swinburne, media analyst at Morgan Stanley, adds: “With competitive intensity rising and cyclical headwinds building, it remains too early in our view to get more bullish on this defensive group within our coverage.”

He sees “the reality of rising cable broadband competition from fixed wireless, an uncertain path to 5G success at Dish [Network], and cyclical pressures at SiriusXM.”

There is some hope, however: Mobile.

With the big three cable operators renewing agreements with mobile partners, it will allow for more “flexibility around packaging and pricing their wireless products within the bundle. Comcast, Charter, and Altice have all come to market with new unlimited wireless offerings starting at $30/line.”

Initial results, according to Swinburne, indicate that net mobile subscribers have initially ticked up.

Longer-term, these companies -- especially Comcast and Charter -- are looking ahead to perhaps move into other modern distribution of content -- the streaming apps distribution business, which Roku and Amazon Fire TV are in. However, those companies have a major head start -- each with around 50 million to 55 million monthly active users currently.

This is not to say that Comcast/Charter (which have a joint venture for a new streaming distribution platform) and perhaps other cable operators, cannot catch up.

Bundling services has always been at the core of their communications operations. Currently, the big bundle elements are cable/video, broadband, and phone (now mobile).

If they can figure out a way to pull in potential consumers -- especially those who are now looking to trim back on services, including cord-cutters -- they might be able to find yet another communication transition.

Then again, those legacy cable TV operators were a key reason why many consumers became “cord-cutters” in the first place: High cable TV monthly fees on the order $90 to $125 a month depending on your favorite estimate.

'Maybe someone needs to redefine then what “bundling” means.